Fifth Annual Report on Foreign Direct Investments Screening : France Strengthens Its Strategic Position in Europe.

A Central Instrument of Economic Sovereignty

Published on 14 October 2025, the European Commission’s fifth annual report on the screening of foreign direct investments (FDI) confirms the growing importance of this mechanism at the core of the Union’s economic and security strategy. Covering data for the year 2024, the report provides a comprehensive overview of investment flows, national screening regimes, and the functioning of the EU cooperation mechanism on FDI screening.

As geopolitical tensions and Russia’s war of aggression against Ukraine continue to shape risk perceptions, the European Union maintains a calibrated approach: keeping markets open while safeguarding security and public order. In this context, FDI screening is no longer a marginal tool—it has become a key instrument of Member States’ economic sovereignty.

Steady Growth Despite Economic Uncertainty

According to the report, the stock of foreign direct investments in the European Union increased by 7.5% between 2023 and 2024, continuing a long-term upward trend that began in 2015. The cumulative number of foreign mergers and acquisitions now stands at 22,302, with 30,108 greenfield investments recorded.

These figures illustrate a remarkable resilience in Europe’s attractiveness, even as annual FDI flows experienced a slight decline: –8.4% in 2024 following –23% in 2023. Mergers and acquisitions nonetheless rebounded (+2.7%), while greenfield investments fell by 19%. This contrast reflects investors’ cautious stance amid geopolitical uncertainties, but also the dynamism of consolidation operations in industrial and technological sectors.

France, the Second-Largest M&A Destination in Europe

France confirms its position as the second-largest European destination for foreign direct investment, behind Germany. In 2024, it recorded 264 merger and acquisition transactions, representing 13% of the European total. Although this marks a slight decrease (–1.1%) compared with 2023, France overtakes Spain, which slips to third place with 230 operations.

This performance is underscored by the high quality of targeted investments: a significant share concerns high-tech sectors, clean energy, and defence—areas at the core of France’s FDI screening regime managed by the Treasury Directorate (DG Trésor).

France registered 191 greenfield investment projects, or 11% of the EU total, behind Spain (24%) and Germany (12%). Despite a nearly 20% decline, France maintains a leading position in the intra-European competition to attract high-value industrial projects.

Manufacturing and ICT Dominate Strategic Sectors

The report highlights that manufacturing remains the primary sector for foreign transactions, accounting for 27% of operations. Information and communication technologies (ICT) follow with 24%, underscoring the growing importance of digital issues in FDI screening policies.

France stands out due to the density of its industrial base and the strategic sensitivity of its key sectors: microelectronics, space, defence, energy, and biotechnology. The inclusion in 2024 of photonics and a new definition of clean energy within the list of activities subject to screening further strengthens the alignment of France’s FDI regime with European priorities.

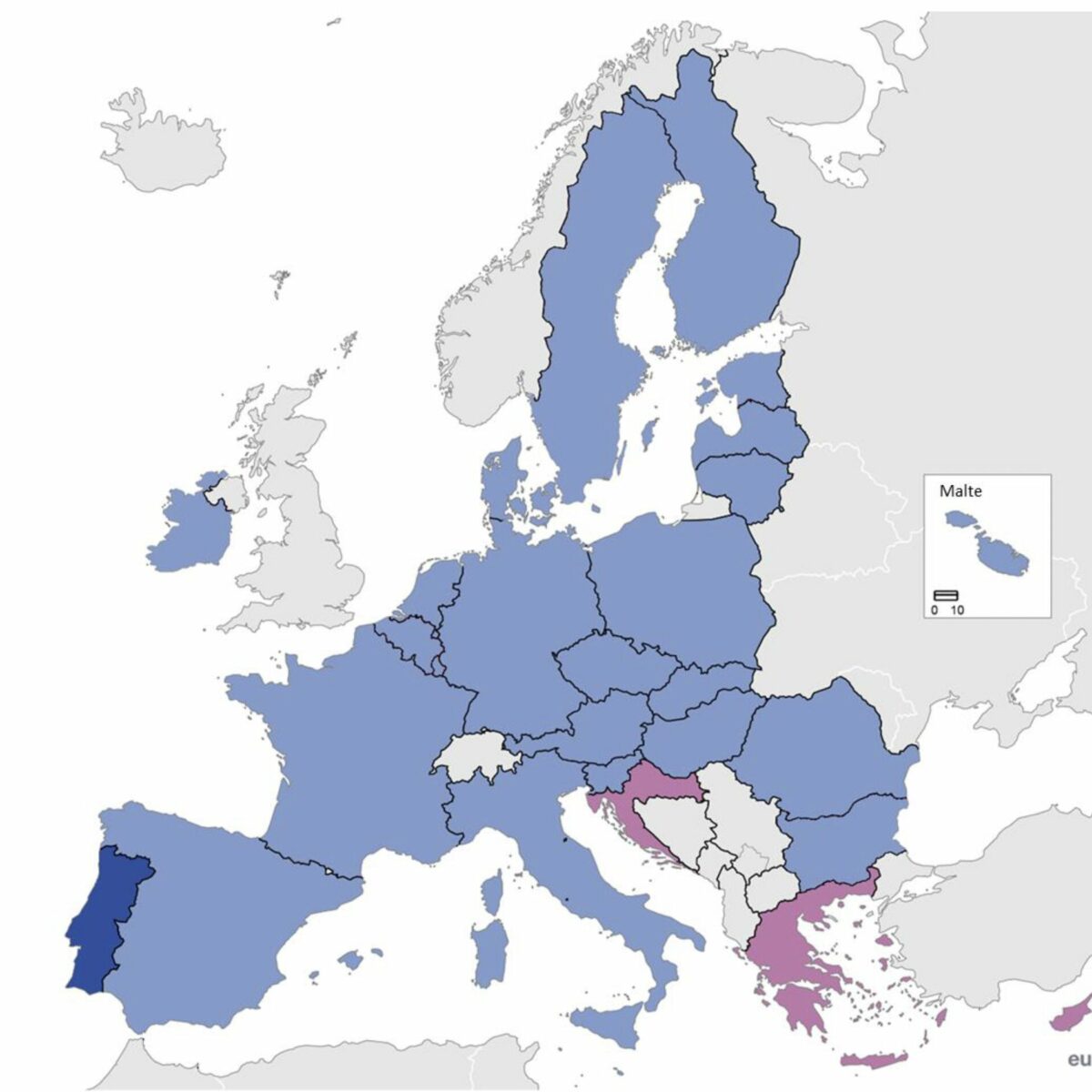

24 Member States Now Equipped with National Screening Mechanisms

By the end of 2024, 24 Member States had adopted FDI screening legislation, compared with 21 in 2023 and only 11 in 2019. The expansion of screening regimes is therefore almost complete, driven by the Commission’s objective of ensuring consistent coverage across the Union.

France is one of the ten Member States that updated their legislation in 2024. The revision of the list of critical technologies illustrates a constant adjustment of the regulatory framework to emerging economic and technological vulnerabilities. This flexible and responsive approach is one of the strengths of the French model, frequently cited as a reference in the Commission’s work on FDI screening.

A Sharp Increase in Screening Volumes, While Remaining Open to Investment

In 2024, national authorities processed 3,136 authorisation requests or ex officio reviews, a rise of more than 70% compared with 2023 (1,808 cases). This surge reflects the growing operational role of FDI screening as an administrative regulatory tool.

Nevertheless, the Union remains open: 86% of reviewed cases were approved without conditions, 9% with mitigation measures, and only 1% were blocked. These proportions—stable since 2021—confirm that FDI screening is not a barrier but a trust-building mechanism that enhances the security of international transactions.

France’s Central Role in the EU Cooperation Mechanism

At EU level, France ranks among the four main contributors to the cooperation mechanism on FDI screening, alongside Spain, Austria, and Italy. Together, these four countries accounted for 76% of the 477 notifications submitted in 2024 (compared with 488 in 2023).

France’s involvement is particularly strong in the manufacturing, technological, and financial sectors, as well as in defence and semiconductor-related projects. This reflects a mature approach, combining national expertise with European coordination. France plays a key role in identifying and assessing security and public-order risks—the very essence of the EU’s FDI screening framework.

Increasing Concentration of Investment Origins

The report notes that the United States and the United Kingdom remain the two main sources of foreign investment in the Union, accounting for 30% and 23% of M&A activity respectively. American investments alone represent 40% of cases notified through the cooperation mechanism, a record level since the entry into force of Regulation (EU) 2019/452.

Investments from China (including Hong Kong) have grown significantly, rising from 6% to 9%. This trend reinforces the need for strict screening of investments in sensitive technological sectors, particularly semiconductors and artificial intelligence.

For France, the concentration of investment flows requires enhanced analysis of ownership chains, beneficial owners, and complex capital structures. The French administration, through the CIEF (Interministerial Committee on Foreign Investments in France), now operates one of the most robust FDI screening systems in Europe.

Technology and Defence Sectors at the Forefront

Transactions subject to in-depth review (phase 2) now primarily involve manufacturing (50% of cases) and ICT (nearly 20%). Across these files, the Commission identifies three main risk drivers: critical technologies (49% of cases), critical infrastructure (26%), and essential inputs (20%).

Within critical technologies, defence-related activities now account for the largest share (37%), followed by semiconductors (21%) and aerospace (16%). These figures highlight the role of FDI screening in safeguarding industrial sovereignty.

Given its strong defence and space industries, France is naturally central to these assessments. FDI screening is viewed not as an obstacle to attractiveness but as a tool for strengthening competitiveness and economic security.

Towards Greater Harmonisation of the EU Regime

In January 2024, the European Commission published a proposal to revise the FDI Screening Regulation, aiming to reduce divergences among national regimes.

Key objectives include:

• ensuring that all Member States operate an effective mechanism;

• establishing a common minimum scope;

• including EU-based investors ultimately controlled by third-country entities;

• strengthening cooperation and transparency between national authorities and the Commission.

France actively supports this initiative, considering that greater harmonisation will prevent distortions of competition and enhance legal predictability for economic actors.

From Inbound to Outbound Investment: A New Area of Scrutiny

Beyond inbound flows, the Commission has expanded its approach to the monitoring of outbound investments. Recommendation (EU) 2025/63, adopted on 15 January 2025, invites Member States to assess outbound investment operations by European companies into third countries in three high-risk technology areas: semiconductors, artificial intelligence, and quantum technologies.

France—already supported by a strong FDI screening culture—has significant strengths to expand its expertise in this new area: deep knowledge of technological value chains, strong interministerial coordination, and close dialogue with businesses.

Conclusion: A Strengthened French Model Within a More Coherent European Framework

The fifth report on the screening of foreign direct investments illustrates the growing maturity of the European system: 24 operational national mechanisms, nearly 500 annual notifications, and strengthened cooperation among Member States.

France occupies a prominent position: second destination for FDI in Europe, fourth contributor to the cooperation mechanism, and a pioneer in adapting its national framework. Continuous regulatory updates, the expansion of critical technologies, and the professionalisation of the CIEF confirm the robustness of the French FDI screening model.

Over the past decade, FDI screening has evolved from a technical instrument into a pillar of European economic security. For France, it now constitutes a genuine lever of strategic power—protecting national interests while remaining one of the continent’s most attractive economies.